Did you know that:

• Floods are the #1 natural disaster in the United States.

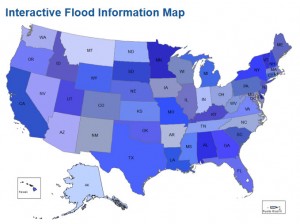

• All 50 states have experienced floods or flash floods in the past 5 years

• Everyone in the United States lives in a flood zone.

And did you also know that:

• Most homeowners insurance does not cover flood damage

Why does this matter?

Floods are defined by the insurance industry as “a general and temporary condition of partial or complete inundation of two or more acres of normally dry land area or of two or more properties”

Because homeowner insurance policies usually contain language that excludes coverage for water damage from floods, if you don’t have flood insurance the cost for restoration and replacement comes out of your pocket!

Flood insurance covers overflow of inland or tidal waters (i.e., storm surge) and unusual and rapid accumulation or runoff of surface waters from any source.

What flood insurance covers: The 2 kinds of flood insurance:

“Building Coverage” Flood insurance covers your home’s foundation elements. It will also cover equipment that’s necessary to support the structure like a furnace, hot water heater and circuit breaker.

Other items are covered under “contents coverage” like your washing machine and dryer, or your freezer and the food in it.

The NFIP encourages people to purchase both building and contents coverage.

What’s worse than not having flood insurance for your home or business?

Purchasing flood insurance too late to help you recover from flood damage!

In most cases, it takes 30 days after you purchase a policy for it to take effect, so it’s important to buy insurance before the storm season starts and floodwaters start to rise.

As the premiere restoration company for the Greater Philadelphia region, we have seen so many homeowners, business owners and property managers struggle with the costs, dangers and health risks after flood damage from storms like Hurricane Irene, Tropical Storm Lee, and Hurricane Sandy.

So we urge you, before the intense Spring rains and the hurricane season starts, talk to your agent about flood insurance!

If you don’t have an agent, you can locate one here: https://www.floodsmart.gov/floodsmart/pages/choose_your_policy/agent_locator.jsp

And remember, if you need expert flood damage restoration PuroClean Emergency Recovery Services is here for you 24 hours a day, 7 days a week. In the Greater Philadelphia and Southern New Jersey region call 877-750-7876.

Pingback: What's all the fuss about Category 3 Black Water Damage?

Pingback: Private Sector Preparedness and PuroClean Emergency Recovery Services